Summary

This section describes how I defined and executed the go-to-market strategy to drive growth for CMO Software. This includes defining the ICP, creating vertical messaging and launching and relaunching the product in new and existing markets.

Situation

CMO Software provided software to help organisations manage their Environmental, Health and Safety risk. Before I joined, they had established a product-market fit and had sold to approximately 50 customers, mainly based in the UK, northern Europe and Australia. Before I joined, they had taken new investment to expand geographically and appointed a new CEO to replace the company founder.

Task

I joined the company shortly after a new CEO with the initial remit from him of “tell me where my next 50 customers are,” create a complete go-to-market plan to target them and develop messaging and associated collateral.

Actions

Identifying The “Next 50” Candidates

As we already had a good product-market fit and established customers, my first task was identifying and codifying our Ideal Customer Profile (ICP) characteristics. This involved:

- Desk work – I analysed the customer base to establish patterns such as company verticals, geography and company size

- Customer interviews – I interviewed 22 customers to gain a solid understanding of the use cases they were using our software to solve.

This work resulted in me identifying the key verticals for the company to focus on were:

- Oil & Gas

- Transport – with particular emphasis on maritime and aviation

- Chemical Manufacturers

- Construction

- Mining

Using the information from my research, I created a Target Addressable Market based on the largest companies in each sector. Using data from Verdantix (a specialist EHS analyst firm), I was able to estimate potential revenues for each company in the TAM. Using this list and insights gained from customer interviews on go-to-market requirements (e.g. to sell to airlines in certain Middle East countries, we needed to go through specific systems integrators), I worked closely with our Chief Revenue Officer to put a sales plan in place which includes hiring the right resources in each region.

Vertical Messaging

During the customer interviews, I discovered that one of the primary use cases revolved around industry-specific regulations. For example, the aviation industry needed to comply with EC376/2014 and FAA SMS, while maritime companies needed to ensure they implemented MARPOL, SOLAR and ISPS. I used this information to create targeted vertical messaging to appeal to each industry (see below.)

To help market to the key industries, I created Solutions Guides for each vertical. Examples of these include:

- Safety Management Solutions for Aviation – Implementing continuous safety improvements

- Maritime EHS Solution – Implementing MARPOL, SOLAS, ISPS and other maritime regulations

Additional Materials

During the above research, I identified several other messaging and collateral requirements that were needed to accelerate sales:

Standard Customer Collateral

Due to the nature and cost of the solutions, the decision-making process often involved senior executives. The existing collateral (e.g. the Customer Two Page Overview) was either too high level or too technical to help explain the benefits of our solution to senior executives. In addition, because the subject of EHS and the software to support the associated processes can be complex and involved, it was necessary to create more approachable messaging that senior decision-makers could relate to. To achieve this, I created the S.A.F.E.R. Framework (Strategize, Assess, Formalize, Engage, Review) and explained the concept in Environmental Health and Safety Guidelines for Senior Executives.

In addition, customer feedback from the interviews indicated that they did not see us as innovative compared to our competitors. To address this, I created the concept of “CMO Labs” encompassing our research. To highlight the research, I wrote a set of whitepapers, including – CMO Labs – Innovation Research for a Safer Future. These documents gave customers and prospects assurances that we were investing in innovation and helped set us apart from our competition.

Sales Enablement

To ensure sales were fully aware of any updated or new messaging created, I carried out regular sales enablement sessions in the form of face-to-face or video training. I also regularly provided them with sales enablement documentation, including Solutions Overview for Sales.

Results

Using the TAM research, the Chief Revenue Officer built an effective go-to-market team in appropriate regions, focusing on key verticals with the highest potential prospects.

Due to the customer interviews, I gained valuable insights into customer use cases and tailored messaging specifically to target verticals.

Together, these actions resulted in a significant increase in the sales pipeline and formed an attractive proposition, which resulted in the investors selling CMO Software to Mitratech in June 2016.

Challenges

Identifying primary customer use cases proved to be an initial challenge as sales reps on key accounts had either left the company or couldn’t fully articulate the business challenges we solved. To address this, I arranged interviews directly with the customer decision-makers to get primary evidence and anecdotes covering their major use cases.

Finding the relevant data to build the TAM model proved challenging as no single source exists for the different verticals. To solve this, I used a variety of sources. I then spent time cross-referencing resources to increase the model’s accuracy to ensure a reliable forecast of the potential in each vertical and geography.

Once I had created the messaging for each vertical, I needed to verify that it was accurate and relevant to each industry and region before getting sign-off from senior management to progress with various planned sales and marketing campaigns. As well as verifying the messaging with some of the customers I interviewed, I sat on many sales calls where we tested the messaging to determine which parts resonated. I produced new iterations of the messaging based on feedback from the prospect calls.

Summary

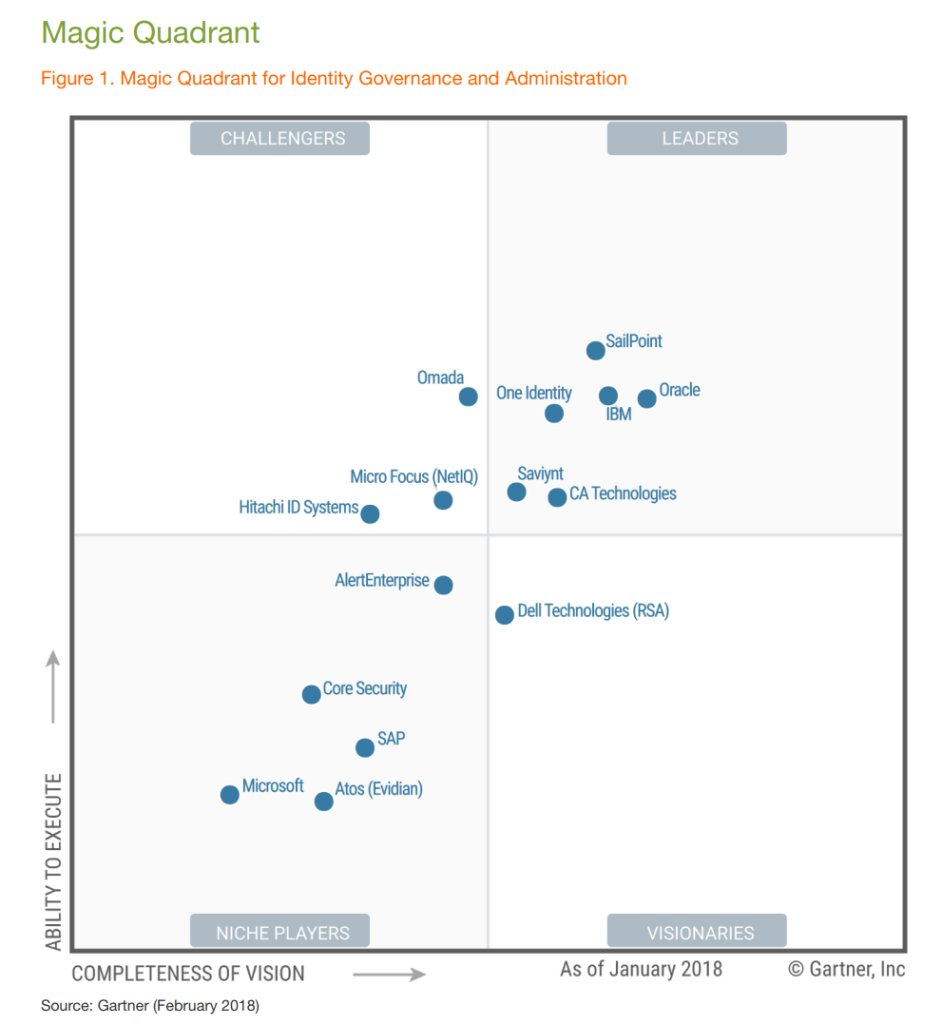

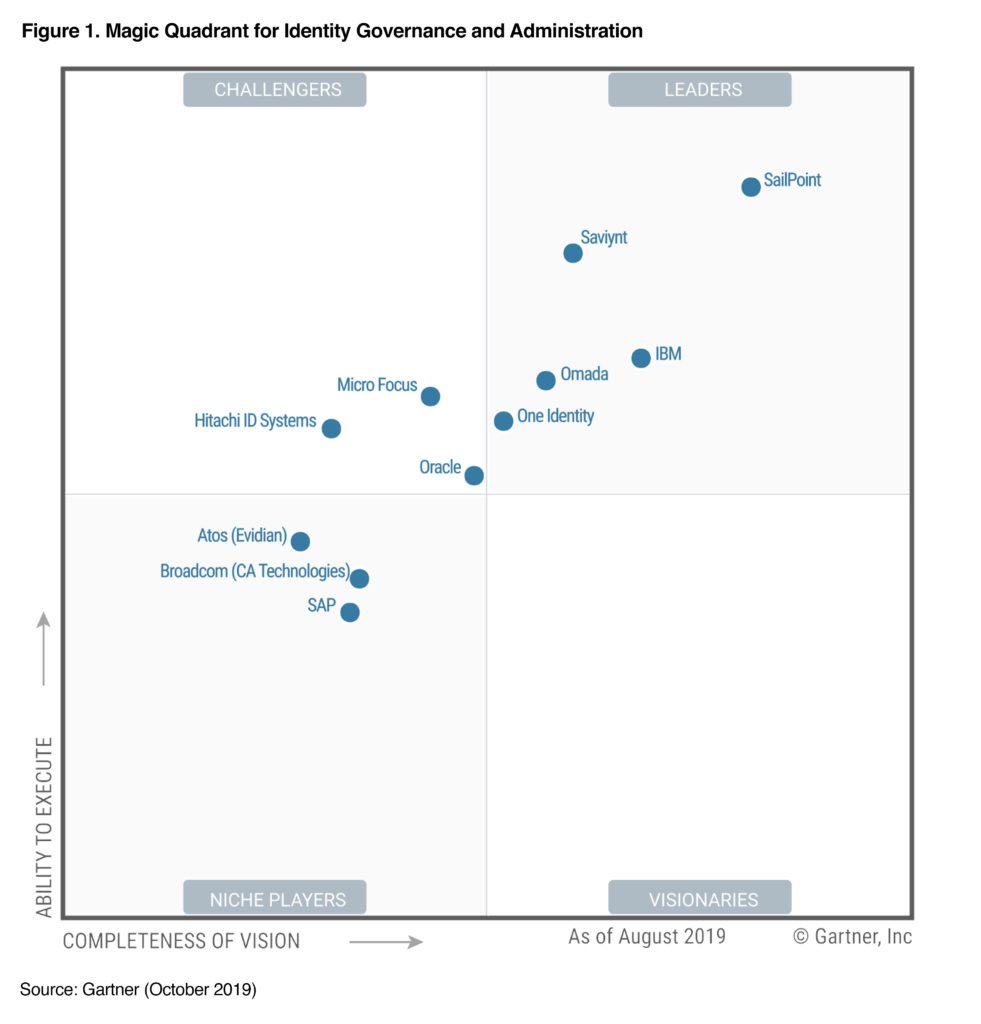

This section describes how the repackaging and launch of a professional services offering resulted in Omada being recognised as a Magic Quadrant “Leader” by Gartner after being unable to move from the “Challengers” quadrant for several years.

Situation

Omada had been in the “Challengers” in Gartner’s Identity Governance and Administration Magic Quadrant for several years and had been unable to move into the Leaders quadrant even though the feedback received from Gartner analysts and customers indicated that the product offering was just as strong as the main competitors who Gartner placed as Leaders.

As a result, companies did not select Omada to participate in RFPs, as they were only shortlisting the Magic Quadrant Leaders.

Task

The CEO tasked me to establish why analysts were not including Omada in the Leaders quadrant and to create a plan to “level the playing field” so that Gartner analysts viewed Omada as equals compared to the Magic Quadrant Leaders.

Actions

To establish why Gartner analysts did not view Omada as a Leader, I held inquiries with each of the four key authors of the Identity Governance and Administration Magic Quadrant. During these sessions, I established where they thought we were solid and where they believed we fell short compared to the competition. After these interviews, it became clear that while they thought we had a strong product and high “overall viability” they did not believe we had a strong implementation offer compared to the competitors. They highlighted that due to the complex nature of the product, this was a critical factor in the success of any implementation.

After internal conversations, I realised that as a company, we not only had a strong implementation offering but the process delighted customers. The issue was that we should have packaged it so that customers and Gartner analysts could understand it.

To address this, I worked with the professional services team to create, package and document a formal implementation offering. The result was IdentityPROCESS+ The Definitive Guide to Identity Governance and Administration Best Practice Processes.

To formally launch this service, I implemented the following:

- A formal sales enablement program to ensure all field reps were able to talk about the offering and handle objections confidently

- A customer launch event at our customer user groups

- Briefings with the key Gartner analysts who covered the Identity Governance and Administration market, including the Magic Quadrant’s authors

During the next Magic Quadrant cycle, I ensured that our response focused heavily on our IdentityPROCESS+ service and that our CTO and VP of Product could articulate the offering when presenting to the authors.

Results

Introducing IdentityPROCESS+ meant we could to articulate the added value and strength of our implementation services. This put us on a “level playing field” with the Leaders in the Magic Quadrant, resulting in Gartner moving Omada to the Leaders quadrant in 2019.

This recognition resulted in substantially more companies selecting Omada for inclusion in RFPs, resulting in a significant contribution to the sales pipeline.

Challenges

Initially, it was difficult to establish why the Gartner analysts were reluctant to position Omada as a Magic Quadrant Leader as they were unwilling to tell us directly. To address this, I held multiple inquiries with the relevant analysts to understand where they saw our strengths and weaknesses. Once they had indicated that they believed our professional services offering needed to be stronger, I compared our public-facing information with the competition and realised that we did look inferior to them, and therefore, that was the most likely cause of only being seen as a challenger.

Once I had determined that I needed to “repackage” the professional services offering, I had difficulty getting sufficient buy-in from senior management that it would be a worthwhile exercise. To address this, I compiled an extensive comparison of the key competitors that were considered Leaders by Gartner to highlight that, on paper, we looked weak regarding our implementation services. This exercise enabled me to demonstrate to the senior management team that we needed to showcase our professional services to “level the playing field” in Gartner’s eyes.

Summary

This section describes the launch of Zivver Insights.

Situation

Zivver had identified that lack of reporting was making it difficult for the technical users of the product to determine whether it was effective at securing their email. They often could not justify the costs to senior management, which resulted in customer churn. To address this, Zivver created Ziffer Insights.

Task

Zivver needed to launch Insights to existing customers and incorporate its messaging as part of collateral and presentations to new prospects.

Actions

My first task was to identify and articulate the problem we were addressing for the customers using their terminology and express how we solved it for them. To do this, I interviewed eight key customers who had all requested “reporting” features. These discussions gave me a clear understanding of how they intended to use the reports to show increases in user adoption, improvements in email security and overall business value to a non-technical audience.

Using this information, I created a Lean Canvas document summarising these messages and other key go-to-market information, such as our key differentiators, ICP, customer impact, competitors and buyer personas. I tested this messaging with five of the customers interviewed previously to ensure that I understood the initiatives they would use the product for and that the messaging resonated with them. I also validated the messaging with internal stakeholders such as the executive team, product manager and sales to ensure accuracy and buy-in.

Once the stakeholders had agreed on the initial high-level messaging, I created other collateral including a Zivver Insights Best Practices eBook, a Help Center article for knowledgeable existing users, a presentation for the customer success team to walk through the key points with the existing customers, and an email to existing customers announcing the release. I also created a script for the Insights Product Manager for the launch video.

Results

The launch saw over 30% of existing users using Insights within the first four weeks after its release and 85% after three months. As anticipated, this high level of adoption significantly reduced the churn rate due to technical users demonstrating the use of the product to the key budget holders within their organizations.

Challenges

There were no significant challenges when creating the messaging for existing customers, as most of them had either been unable to justify the product to their non-technical managers or had spent considerable time creating reports in Excel.

However, the messaging for new customers was more challenging as the reporting feature didn’t come across as significant on its own and was considered “table stakes” by the small number of prospects I had spoken to. To resolve this issue, I wrapped the Insights messaging into the bigger email security story. I positioned the solution as having key differentiators rather than focusing on the new feature. This initially proved challenging as the sales team wanted to focus on positioning the new feature to prospects and required some sales training to explain why that was not necessarily the right approach.